In an increasingly digital world, the concept of a cashless society has gained significant traction. Cashless transactions, driven by technological advancements and evolving consumer preferences, have seen a surge in popularity. This article delves into the advantages and disadvantages of a cashless society, shedding light on both the benefits and pushbacks associated with this transformative shift.

The Benefits of a Cashless Society

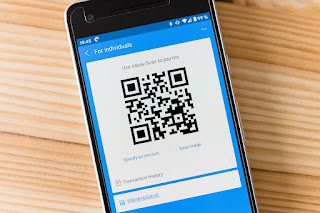

1. Convenience and Efficiency: One of the primary advantages of going cashless is the convenience it offers. Digital payment methods such as credit cards, mobile wallets, and online transfers allow for seamless transactions without the need for physical cash. This streamlined process saves time and effort, both for consumers and businesses, making everyday transactions smoother and more efficient.

2. Enhanced Security: Carrying cash comes with inherent risks, including theft and loss. Digital transactions, on the other hand, provide increased security measures. Robust encryption, fraud detection systems, and biometric authentication methods minimize the potential for unauthorized access and fraudulent activities, ensuring a higher level of security for financial transactions.

3. Financial Inclusion: A cashless society has the potential to foster financial inclusion by providing easier access to financial services for the unbanked and underbanked populations. Digital payment platforms allow individuals without traditional bank accounts to make transactions, receive payments, and save money electronically, empowering them to participate more fully in the economy.

4. Transparency and Accountability: Digital transactions leave a traceable electronic footprint, which promotes transparency and accountability. This characteristic makes it easier to track financial flows, detect illegal activities, and combat tax evasion and money laundering. Governments and financial institutions can leverage this data to better understand economic trends and devise more targeted policies.

The Pushbacks Against a Cashless Society

1. Exclusion of Vulnerable Populations: Despite the advantages, a cashless society raises concerns regarding exclusion. Certain demographics, such as the elderly, low-income individuals, and those with limited access to technology, may face challenges adapting to digital payment systems. This exclusion could perpetuate financial inequality and exacerbate the digital divide.

2. Privacy Concerns: Cash transactions provide a certain level of anonymity, allowing individuals to conduct transactions without leaving a digital trace. In a cashless society, every transaction is recorded, raising concerns about privacy and surveillance. It is crucial to strike a balance between convenience and preserving individuals' right to privacy in an increasingly digitized financial landscape.

3. Technological Reliability and Infrastructure: A fully cashless society relies heavily on technology and robust digital infrastructure. However, technological glitches, system failures, or power outages can disrupt digital payment systems, leaving individuals unable to access their funds or make necessary transactions. This highlights the importance of ensuring reliable and resilient technology infrastructure to mitigate potential risks.

4. Cybersecurity Risks: As digital transactions become more prevalent, the risk of cybercrime and data breaches also increases. Hackers and malicious actors constantly evolve their methods to exploit vulnerabilities in digital payment systems. Safeguarding against cyber threats requires robust cybersecurity measures, continuous advancements in encryption, and heightened user awareness to ensure the protection of financial assets and personal information.

Conclusion

The shift towards a cashless society carries numerous benefits, including convenience, enhanced security, financial inclusion, and improved transparency. However, it is crucial to address the pushbacks associated with this transition. Striving for inclusivity, protecting privacy rights, ensuring technological reliability, and mitigating cybersecurity risks are essential considerations for a successful and equitable cashless society.

As society moves forward, a balanced approach is necessary to harness the advantages of a cashless system while addressing the concerns and challenges that arise. With careful planning, collaboration between stakeholders, and ongoing innovation, the journey towards a cashless society can lead to a more efficient, inclusive system.

No comments:

Post a Comment